CAMDEN – Wildwood Mayor Pete Byron pleaded guilty in federal court for failing to disclose income on federal tax returns.

Byron, 67, admitted March 24 that he did not report income he received over two years when filing his taxes through an accountant.

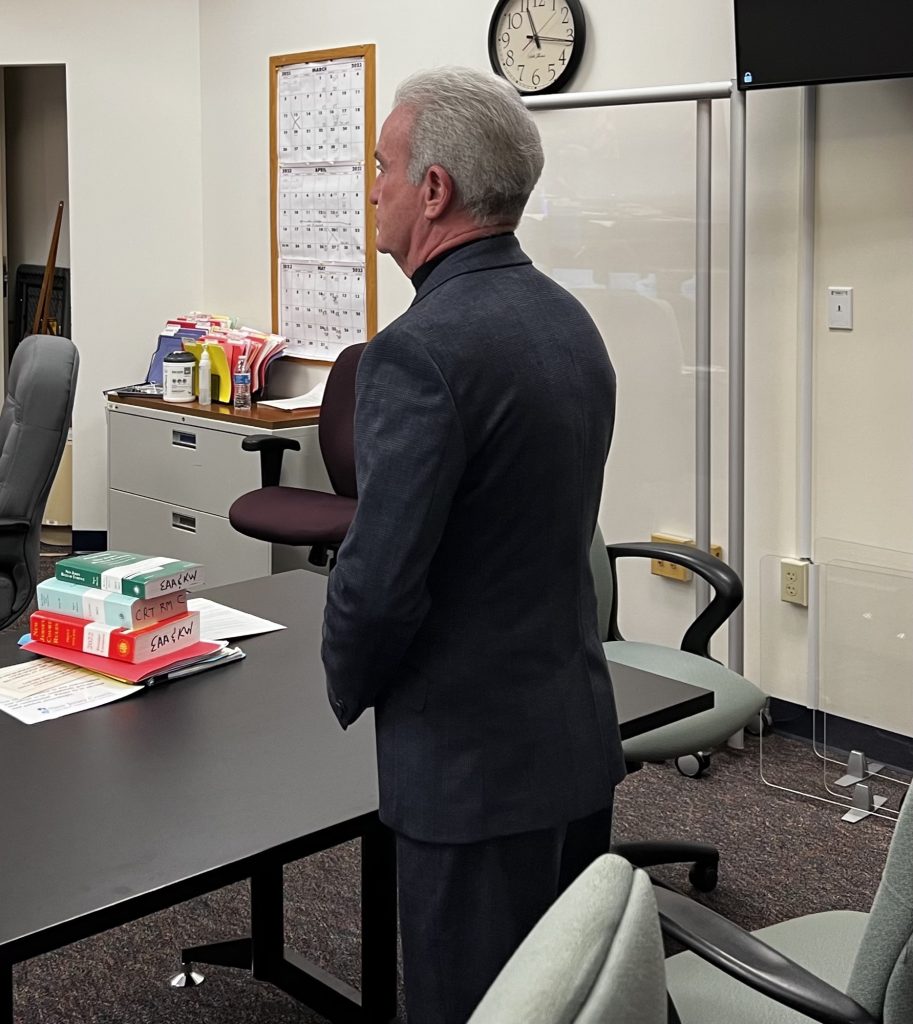

Byron appeared before U.S. District Judge Karen M. Williams and officially entered a plea to two counts of willfully aiding and assisting in the preparation and presentation of fraudulent tax returns to the Internal Revenue Service (IRS) for the years 2017 and 2018.

In the plea agreement, which Byron signed Jan. 9 and was put on the record and accepted by Williams March 24, the Wildwood mayor admitted he failed to pay $7,014 in federal income tax over those two years.

Confronted by federal investigators in May 2020, then-Commissioner Byron admitted he didn’t file his taxes for the years 2017 and 2018 because he did not have the money to pay them. He also acknowledged receiving about $40,000 in income over those years that he did not disclose on the returns.

In a separate case, Byron was indicted in state court on charges he illegally accepted health benefits while serving in public office. He pleaded not guilty to those charges March 17.

Can Byron Still Serve as Mayor?

The city said it is looking into whether Byron would need to be legally removed from the position as a result of his plea, the Herald is reporting exclusively. Byron did not resign as Wildwood’s mayor after signing the plea agreement with federal prosecutors or in the wake of the state indictment. He presided over the Wildwood Board of Commissioners meeting March 22.

Byron did not answer a call to his cell phone from the Herald March 24, after the plea was entered, but responded by text, saying: “can’t comment I wish I could.”

When asked if he planned to continue to serve as mayor, Byron replied by text that he would “rather not comment on that either right now,” later adding, after follow-ups, “end of discussion”.

Wildwood Administrator Steve O’Connor told the Herald he was meeting with the city’s solicitor and exploring the implications of the guilty plea on Byron’s standing as an elected official.

A copy of the plea agreement, which was obtained by the Herald, does not mention any forfeiture of public service as a condition.

Matthew Reilly, a spokesperson for the U.S. Attorney’s Office in the District of New Jersey, said neither the U.S. attorney for the district, Phillip R. Sellinger, nor U.S. Assistant Attorney Thomas S. Kearney, assigned by the government to prosecute the case, were available to comment to the Herald.

“Unfortunately, we do not do interviews on cases while they are being actively litigated,” Reilly said.

He said in a phone call with the Herald that federal prosecutors don’t get involved in those issues.

“It’s up to the town,” he said, using the analogy of a doctor who pleads guilty to charges and faces losing their license to practice. “Whether they lose their license or not, that’s a state function. We don’t get involved in that.”

When reached by phone March 24, Wildwood Solicitor Louis A. DeLollis said the city was still exploring the ramifications of the plea on Byron’s public service, andhe said he was not aware of any decision by Byron to resign.

“I’d be lying to you if I said I’m not trying to wrap my head around it as well. That’s what we’ve been trying to do the past couple of hours. So, there might be parts of this that I’m missing that I’m still trying to wade through and dive into,” DeLollis told the Herald.

DeLollis pointed to a New Jersey statute which he said the city is currently researching.

According to the statute, “A person holding any public office … who is convicted of an offense shall forfeit such office, position or employment if … he is convicted under the laws of this State of an offense involving dishonesty or of a crime of the third degree or above or under the laws of another state or of the United States of an offense or a crime which, if committed in this State, would be such an offense or crime.”

The applicability of the statute may hinge on whether Byron’s admission to hiding income when filing tax returns is a crime of dishonesty.

No Federal Indictment?

Byron pleaded guilty by way of information, meaning he avoided a formal indictment being returned in the case. A. Charles Peruto Jr., a noted Philadelphia defense attorney not involved in Byron’s case, said this type of plea is not at all uncommon in federal court.

“You get a target letter as the defendant. A good white-collar lawyer will then contact the government and find out what they have. It’s called a reverse proffer, where the government tells you what they have. You can make a deal by way of information and avoid an indictment early,” Peruto said. “It’s basically a situation where, if they have a solid case and they’re still investigating, you cut off any further investigation, and just plead guilty to what they have already.”

The Herald has learned that a grand jury investigating Byron had been convening in Camden in late 2022.

The Crime

Key evidence against Byron is an October 2017 letter sent to him representing a job offer, according to prosecutors. According to the information, the letter was sent to Byron from “a law firm located in Gloucester County.”

Neither the law firm, nor the lawyer involved, were identified by the government in court documents. However, a copy of the letter obtained by the Herald reveals that it was sent Oct. 23, 2017, by the firm Long Marmero & Associates LLP, with offices in Vineland, Mount Holly, and Tinton Falls.

From June through August 2017, Byron sent multiple emails to the managing partner of a law firm located in Gloucester County, seeking assistance in obtaining a job, prosecutors said.

Shortly thereafter, in September 2017, the managing partner opened a new “consulting services” company. The October 2017 letter from the firm states Byron was offered a job selling marketing and payment solution programs by the company it represented, which the letter identifies as Hydro 2O LLC.

According to the terms of the October 2017 letter, Byron was to receive an annual salary of $50,000 to work for the company. He was to receive payments twice a month, beginning Oct. 30, 2017, for his work with the company.

From October 2017 through September 2018, Byron received $40,425 in payments from the company, according to court documents.

He did not report this income on his tax returns for calendar years 2017 and 2018, resulting in the $7,000 tax loss to the IRS, he admitted in court.

What to Expect at Sentencing

The tax charges each carry a maximum potential sentence of three years in prison and a maximum fine of $250,000 or twice the gross amount of any pecuniary gain that any persons derived from the offense, whichever is greater, prosecutors announced.

However, Byron will likely serve nowhere near three years in prison for the offense, if he even serves time at all.

At sentencing, federal judges rely on guidelines based on a defendant’s criminal history and the offense level. There is no negotiated sentence in the plea.

Stipulations attached to the plea agreement also show that because Byron accepted responsibility and pleaded guilty, there is a recommended downward adjustment of two offense levels, from his original score of a level 10 to a level 8.

Assuming Byron has a criminal history score of zero or one, the recommended custodial sentence would be between zero and six months. The judge would have discretion to sentence him to whatever she feels is appropriate within those guidelines.

His open charges in New Jersey would not affect his criminal history score because they have not been proven.

Byron agreed not to appeal a sentence if it does not exceed six months and the government agreed not to appeal a noncustodial sentence. The Wildwood mayor also agreed to pay full restitution to the IRS as a condition of the plea.

He was released on $100,000 unsecured bond, meaning he posted nothing but will owe $100,000 if he does not appear as required.

Byron must also abide by certain conditions prior to sentencing. He was ordered to surrender his passport, report to pretrial services, not possess a firearm, and other conditions.

Sentencing is scheduled for Aug. 2.

To reach the reporter with information or questions, call 609–886-8600, ext. 142, and leave a message or email sroddy@cmcherald.com.