Homeowner With an Average Assessment Will Pay $42 More

PETERSBURG – Upper Township homeowners with the town’s average assessment will pay $42 more in taxes this year to support the municipal budget introduced by the Township Committee on Monday, Feb. 26.

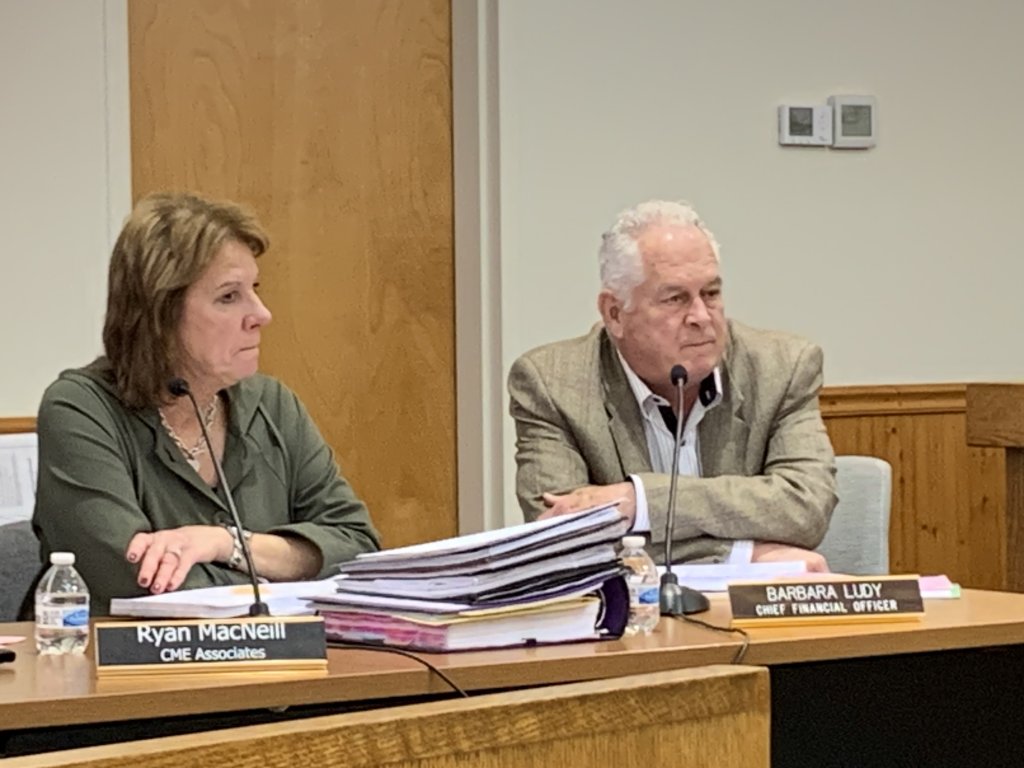

Business Administrator Gary DeMarzo said the $17.6 million budget calls for a 1.4-cent increase in the 2023 tax rate to cover a combined $300,000 in debt service and employee obligations.

Municipal Auditor Leon Costello, who was present for the budget introduction, called the 2024 budget “a very sound budget,” coming after a year of turmoil. The turmoil he referred to was related to double-digit health insurance rate increases. The tax rate increased 2.8 cents in 2023 to cover an additional $550,000 in expenses.

The 2023 tax rate was 28 cents per $100 of assessed value, and it will increase to 29.43 cents per $100 of assessed value. For a home valued at $300,000, the municipal tax rate would cost the homeowner $839.70 in local purpose taxes. In 2024, that amount would increase to $881.70, or another $42 over the year.

Costello said the budget is $580,000 under the state-mandated spending cap and $750,000 under the state’s levy cap.

“You are well below the caps – everything has settled down,” he said.

DeMarzo said the township collects over $41 million in taxes, but only $17.6 million stays in the township to cover township expenses, with the rest going to pay for debt service on capital expenses.

Breaking down the $41 million into percentages, DeMarzo said the school district accounts for 71% of the taxes collected, the county gets 16%, and 13% stays with the township.

“We are a collection agency,” DeMarzo said. “We collect $41 million, and Upper Township receives $5 million.”

The administrator said that for every $1,000 the township collects in taxes, it keeps only $120 to apply to the township’s needs, 70% of which are employee-related costs.

“This budget solves what we have to do for the operating year,” he said.

The increase amounts to about another $300,000 in the budget. DeMarzo said that equates to the owner of a $300,000 home, the township average, paying an additional $42 for the year, or $3.55 more per month, in 2024.

Mayor Jay Newman said the Township Committee is trying to keep the tax rate as low as it responsibly can.

Costello said there will be a second reading and public hearing on the 2024 budget on Monday, March 25, at 4:30 p.m.

Contact the author, Christopher South, at csouth@cmcherald.com or 609-886-8600, ext. 128.