PETERSBURG – Upper Township led all county municipalities in 2022 for the percentage increase in its local purpose tax rate, which rose by 15%. Even with that increase, the municipality is still among the lowest municipal tax rates in the county at $0.252 per $100 of assessed value.

The municipality’s budget reported a taxable valuation of $1,892,524,400 and a current year average residential assessment of $285,162, which represents an increase in total valuation over five years of less than 2%.

In land area, the municipality is the second largest in the county after Middle Township. It has a population in the 2020 census of 12,539, just 1% up from its 2010 census figure of 12,373.

The municipality does not maintain a municipal police force, electing to rely on State Police who patrol and respond from their barracks in neighboring Woodbine. This practice eliminates a major expense from the municipal budget.

The municipality has also been home to the B.L. England generating station in Beesley’s Point. The municipal energy tax receipts, collected by the state and returned to municipalities with the euphemistic label of state aid, have continued to feed the municipal budget even after the plant was shut down in 2019.

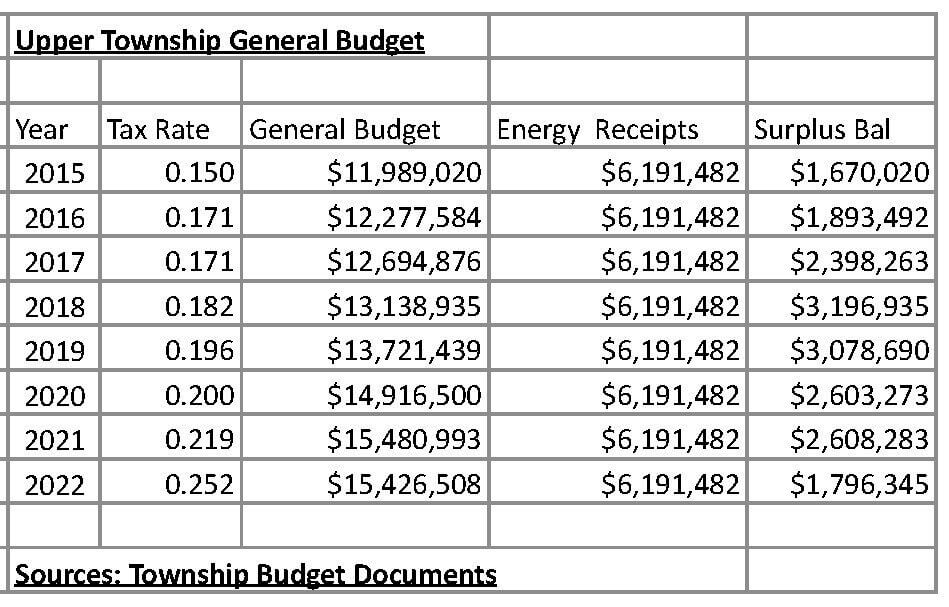

The amount of revenue that the energy tax generates for the municipality dwarfs all other forms of revenue, including the local purpose tax. However, the over $6 million in revenue from the plant is a static sum and increases in municipal costs must rely on other sources of revenue.

The municipal tax rate in the municipality has increased by 68% since 2015. The revenue from the energy receipts tax has remained level in absolute terms but it has declined as a percentage of the municipality’s total revenues from 52% in 2015 to 40% in 2022.

Upper Township has no separate self-financing utilities. The municipality is run completely from its general budget. That general budget has risen by $3.4 million since 2015 with the growth of the tax levy covering 60% of that increase. The municipal tax has moved from being 22% of total revenue to now constituting 31%. It is largely the impact of the municipality’s largest revenue source – the energy tax – being static.

In order to keep the municipal tax as low as possible, Upper Township follows the same practice as every municipality in the county – it inserts surplus funds into the budget as revenue with the expectation that it will be able to return those funds to the surplus balance by the end of the budget year.

That has not worked out as well as it could have. The surplus balance, which had reached a peak in 2018 at $3.2 million, declined to $1.8 million entering 2022. The use of $1.65 million for the 2022 budget means the balance is now at less than $150,000, making replacing the surplus used a priority this year.

For two years running now, the municipality has made use of federal Covid relief funds as revenue, inserting $485,000 of American Rescue Plan funds into the 2022 budget. Those funds will not be available in 2023.

In appropriations, the municipality uses about 8% of total revenue for debt service. Its largest areas of government expenses are Public Works followed by insurance expenses.

According to the municipality’s user–friendly budget for 2022, there are 60 budgeted full-time positions and 80 part-time. Total personnel costs run to $6.5 million or about 42% of general budget revenues.

The municipality makes strong use of shared service agreements. The budget for 2022 lists 18 separate agreements. In nine of the agreements, the municipality has the lead role and in the other half, it is the recipient.

Even though the municipality has one of the lower municipal tax rates, it had the second highest total tax rate, second only to Wildwood.

The culprit here is the highest district school tax in the county. While it is true that most county school districts have been losing state aid for over seven years, the local district tax in Upper Township is noticeably higher than in other county districts, according to the 2021 Cape May County Tax Rate Summary.

Have any thoughts and/or information on this topic? Email vconti@cmcherald.com.