COURT HOUSE – Sen. Michael Testa (R-1st) said state school aid cuts for fiscal year 2024, announced by the Murphy administration, will be devastating for schools, students, and property taxpayers in the First Legislative District. The fiscal year 2024 cuts in Cape May County amount to a loss of $3.4 million compared with fiscal year 2023.

The loss of funds is not across all county school districts. Of the 18 county districts, half will see some increase in funding. Those nine districts will cumulatively receive $2.1 million in funding over the fiscal year 2023 levels. The problem is that the other nine districts will combine to lose $5.6 million in state aid.

The biggest losers of aid are Wildwood City School District, which is projected to lose $2.1 million or almost 53%, and Upper Township School District, with a decline in funding of $1.4 million or almost 23% of previous state aid.

| Cape May County State School Aid for Fiscal Years 2023 and 2024 | ||||

| School District | Fiscal Year 2023 | Fiscal Year 2024 | Change | % Change |

| Avalon | $56,107 | $67,254 | $11,147 | 19.87% |

| Cape May | $1,481,527 | $1,626,192 | $144,665 | 9.76% |

| Cape May Tech | $1,396,049 | $1,396,049 | $0 | 0.00% |

| Cape May Point | $6,164 | $2,027 | -$4,137 | -67.12% |

| Dennis Township | $2,127,572 | $1,574,187 | -$553,385 | -26.01% |

| Lower Cape May Regional | $4,594,149 | $4,056,959 | -$537,190 | -11.69% |

| Lower Township | $4,692,677 | $3,797,547 | -$895,130 | -19.08% |

| Middle Township | $12,587,047 | $13,900,581 | $1,313,534 | 10.44% |

| North Wildwood | $353,451 | $296,902 | -$56,549 | -16.00% |

| Ocean City | $4,331,249 | $4,529,395 | $198,146 | 4.57% |

| Sea Isle City | $194,165 | $177,762 | -$16,403 | -8.45% |

| Stone Harbor | $47,254 | $51,952 | $4,698 | 9.94% |

| Upper Township | $6,004,942 | $4,652,149 | -$1,352,793 | -22.53% |

| West Cape May | $610,292 | $654,254 | $43,962 | 7.20% |

| West Wildwood | $46,292 | $53,997 | $7,705 | 16.64% |

| Wildwood | $4,052,785 | $1,912,821 | -$2,139,964 | -52.80% |

| Wildwood Crest | $604,841 | $599,341 | -$5,500 | -0.91% |

| Woodbine | $3,059,018 | $3,473,745 | $414,727 | 13.56% |

| Total | $46,245,581 | $42,823,114 | -$3,422,467 | -7.40% |

| Source: NJ Department of Education, Office of School Finance | ||||

What is happening? The same thing that has been happening since the state made the decision in 2018 to phase out adjustment aid. The process was somewhat obscured during the pandemic, as money flowed to K-12 school districts from federal legislation intending to aid schools in the disruptions that the pandemic brought about and to support needed building modifications and improvements.

Adjustment aid dates back to the court approved School Funding Reform Act (SFRA) in 2009. The new formula for state aid to K-12 districts meant significant reductions in aid for many rural and lower-populated districts, especially in the southern counties. The state responded with adjustment aid, often called “hold harmless” aid, for nine years. This aid blunted the impact of SFRA formula driven aid until another fateful decision in 2018.

In 2018, the state decided that it would end the adjustment aid, phasing it out over a period of seven years. The vast majority of the state aid being lost in counties like Cape May is a result of this process.

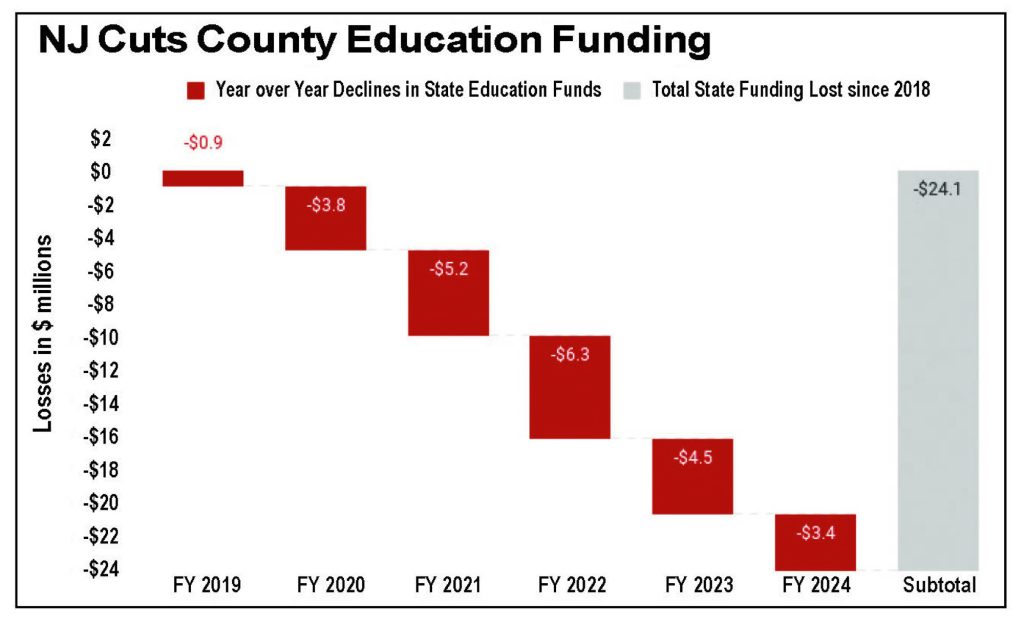

In fiscal year 2019, total state aid to Cape May County school districts totaled $64.4 million. The projection for fiscal year 2024 is $42.8 million, a difference of $21.6 million. State adjustment aid to county districts dropped $18.9 million in that period, almost 90% of the total decline in state aid.

The uneven distribution of the reductions has left some districts, Wildwood being the prime example, with enormous cuts. Local political leaders and education officials have called for more funding, especially in light of a fiscal year 2024 governor’s budget that touts its sharp rise in education funding.

The cry for more aid is especially stringent as all districts, including those that are on the wrong side of the state formula driven aid process, are grappling with unprecedented levels of learning loss and a window for using federal relief funds that is closing.

The fight to maintain adjustment aid has been a long one. As far back as 2017, school districts in the county prepared an analysis of the potential impact of losing adjustment aid. It fell on deaf ears.

Then-Senate President Steve Sweeney said the districts got adjustment aid for nine years, during which time they should have adjusted their budgets.

Now, the county’s 18 school districts could be facing a fiscal year 2024 in which total adjustment aid remaining on the books is $2.7 million, and even that is scheduled for future phaseout.

The formula that drives state aid is a complicated one, filled with numbers, weights, and multipliers. It produces winners and losers. Its intent is to drive more state dollars to districts that need it most and that have the most constrained capacity to raise their own sources of revenue, meaning property taxes.

Arguments abound. Some districts claim the state is working from flawed data. Others argue that the process lacks transparency, especially with respect to the multipliers the state uses. There has even been litigation over the formula.

One study by the New Jersey Policy Perspectives in 2020 makes the case that the SFRA formula results in some districts being funded who have the greatest capacity to raise alternative sources of revenue.

Other districts, receiving declining state aid, are often forced to spend below adequacy targets, which is the ultimate constitutional requirement that involved the courts in the first place, the requirement to provide a thorough and efficient education, known in the formula as adequacy costs.

One can easily get lost in the morass of state calculations. At issue is the continued phase out of adjustment aid. This decision back in 2018 is at the source of the funding crisis some districts are experiencing.

There are two major streams of revenue that drive K-12 budgets, state aid and local property taxes. The debate is over who pays what share. How much of the cost of education, considered to be the minimum adequacy costs, should the community pay through taxes? Subtract the local cost share from the minimum adequacy budget, and one is supposed to get the state contribution through what is termed equalization aid. In reality, state aid is less a function of meeting adequacy costs and more one of what the state decides it can afford.

In a 2007 document, the state Department of Education acknowledged “the need for a permanent, formulaic remedy for all districts.” That document, A New Formula for Success, is a maze of calculations and weights.

The result is still a process that puts a great deal of weight on local property taxes to ensure the constitutional obligation of a “thorough and efficient” education.

Contact the author, Vince Conti, at vconti@cmcherald.com.